The PostTrans XML API for Sage 200 posts Nominal Journals, Reversing Nominals and Recurring Journals into Sage 200, from a simple XML file, submitted to import directory or IMAP e-mail account.

After posting the file is moved to a processed folder, and the Transaction Reference is added to the top of XML file. If the file fails validation, then the error/errors are appended to the top of the file. A user can then easily edit and resubmit to PostTrans XML API for Sage 200.

List of Tags/Entities for mapping are at bottom of page.

Click here for an overview of the XML API for Sage 200

Demonstration Video

PostTrans XML API for Sage 200 Nominal Journal

| |

0:00 |

Where to get help |

| |

1:00 |

Where to import from |

| |

1:40 |

Open example and walk tNominal Journal XML API |

| |

4:00 |

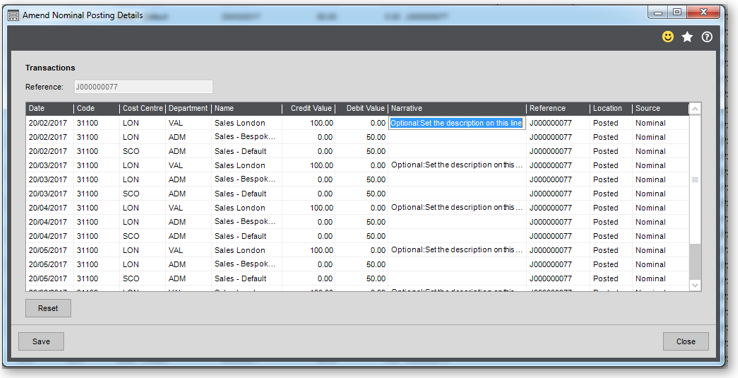

Post Nominal Journal into Sage 200 |

| |

4:30 |

The proof |

List of Examples

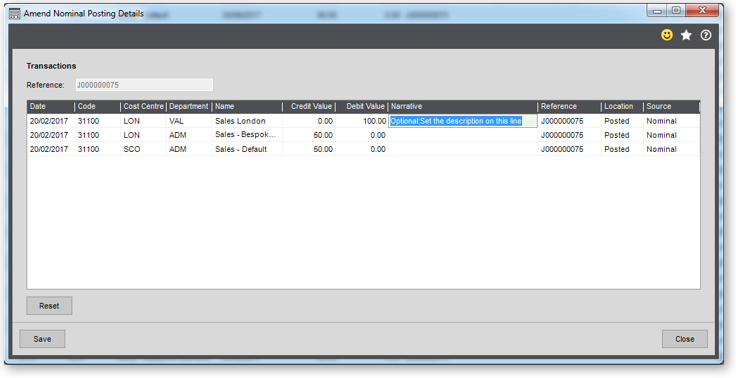

Example – 200 Nominal Journal Amount.xml

<?xml version="1.0" ?>

<sage200Data>

<settings>

<companyCode>DEMO03</companyCode>

<mappings>

</mappings>

</settings>

<NomHeader>

<!-- ===== Header ==== -->

<THJournalType>NOM</THJournalType> <!-- Text 3 - Journal Type NOM, BAT or REV only -->

<!-- Values:NOM,Normal Journal,REV,Reversing Journal,REC,Recurring Journal-->

<THDate>2017-02-20</THDate> <!-- Date - Overide Heading Date, thus causing a new transaction on change -->

<THRef>My Test using Cr/Db </THRef> <!-- Text 30 - Overide Heading Ref, thus causing a new transaction on change -->

<!-- using Sage API 200 post three line Nominal Journal user either

<TLAmount> or <TLDebit> and <TLCredit>

to define the amounts which must balance -->

<NomLine>

<TLDetails>Optional:Set the description on this line</TLDetails> <!-- Text 60 - Details -->

<TLExterRef>Optional:And an External ref</TLExterRef> <!-- Text 30 - External Referance -->

<TLNomCode>31100/LON/VAL</TLNomCode> <!-- Credit -->

<TLAmount>-100</TLAmount>

</NomLine>

<NomLine>

<TLNomCode>31100/LON/ADM</TLNomCode>

<TLAmount>50</TLAmount> <!-- Debit -->

</NomLine>

<NomLine>

<TLNomCode>31100/SCO/ADM</TLNomCode>

<TLAmount>50</TLAmount> <!-- Debit -->

</NomLine>

</NomHeader>

</sage200Data>

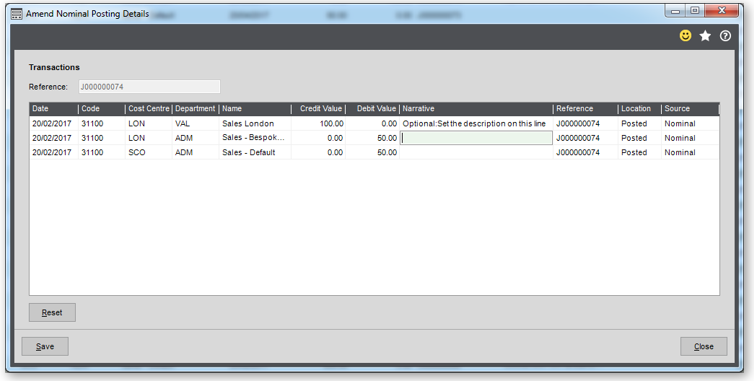

Example – 210 Nominal journal CrDb.xml

<?xml version="1.0" ?>

<sage200Data>

<settings>

<companyCode>DEMO03</companyCode>

<mappings>

</mappings>

</settings>

<NomHeader>

<!-- ===== Header ==== -->

<THJournalType>NOM</THJournalType> <!-- Text 3 - Journal Type NOM, BAT, REC or REV only -->

<!-- Values:NOM,Normal Journal,REV,Reversing Journal,REC,Recurring Journal-->

<THDate>2017-02-20</THDate> <!-- Date - Overide Heading Date, thus causing a new transaction on change -->

<THRef>My Test </THRef> <!-- Text 30 - Overide Heading Ref, thus causing a new transaction on change -->

<!-- using Sage API 200 post three line Nominal Journal user either

<TLAmount> or <TLDebit> and <TLCredit>

to define the amounts which must balance -->

<NomLine>

<TLDetails>Optional:Set the description on this line</TLDetails> <!-- Text 60 - Details -->

<TLExterRef>Optional:And an External ref</TLExterRef> <!-- Text 30 - External Referance -->

<TLNomCode>31100/LON/VAL</TLNomCode>

<TLDebit>100</TLDebit>

</NomLine>

<NomLine>

<TLNomCode>31100/LON/ADM</TLNomCode>

<TLCredit>50</TLCredit>

</NomLine>

<NomLine>

<TLNomCode>31100/SCO/ADM</TLNomCode>

<TLCredit>50</TLCredit>

</NomLine>

</NomHeader>

</sage200Data>

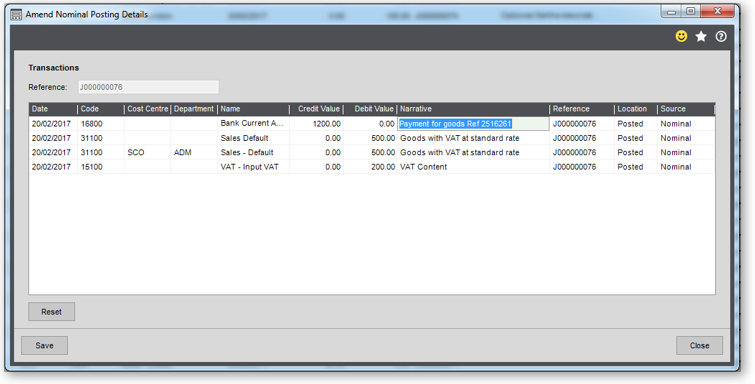

Example – 220 Nominal Journal with VAT.xml

<?xml version="1.0" ?>

<sage200Data>

<settings>

<companyCode>DEMO03</companyCode>

<mappings>

</mappings>

</settings>

<NomHeader>

<!-- ===== Header ==== -->

<THJournalType>NOM</THJournalType> <!-- Text 3 - Journal Type NOM, BAT, REC or REV only -->

<!-- Values:NOM,Normal Journal,REV,Reversing Journal,REC,Recurring Journal-->

<THDate>2017-02-20</THDate> <!-- Date - Overide Heading Date, thus causing a new transaction on change -->

<THRef>My Test </THRef> <!-- Text 30 - Overide Heading Ref, thus causing a new transaction on change -->

<!-- Sage 200 allows the follwoing line types for Sales Orders and Invoice sent to Invoice module

VAT rounding can often be a problem, this example calcs the Net and VAT from

Inclusive of VAT value -->

<NomLine>

<TLDetails>Payment for goods Ref 2516261</TLDetails>

<TLNomCode>16800</TLNomCode> <!-- Bank Account Nominal -->

<TLCredit>1200</TLCredit>

</NomLine>

<NomLine>

<TLNomCode>31100</TLNomCode>

<TLDebit>500</TLDebit>

<TLDetails>Goods with VAT at standard rate</TLDetails> <!-- Text 60 - Details -->

<TLTaxType>1</TLTaxType> <!-- Integer - Tax type, which selects Input or Output Nominal Code -->

<!-- Values:0,N/A,1,Input Goods,2,Input Tax,3,Output Goods,4,Output Tax-->

<TLTaxCode>1</TLTaxCode> <!-- Integer - Tax Code. Make sure the format of the cell is “General” else search may not work properly -->

<!-- Values:List as defined in Sage 200. 0=0% Exempt,1=Standard Rate,2=Zero Rated,4=EC Zero SL,5=EC Service SL,6=EC Service PL,7=EC Zero PL,8=EC Std PL etc.-->

</NomLine>

<NomLine>

<TLNomCode>31100/SCO/ADM</TLNomCode>

<TLDebit>500</TLDebit>

<TLDetails>Goods with VAT at standard rate</TLDetails> <!-- Text 60 - Details -->

<TLTaxType>1</TLTaxType> <!-- Integer - Tax type, which selects Input or Output Nominal Code -->

<!-- Values:0,N/A,1,Input Goods,2,Input Tax,3,Output Goods,4,Output Tax-->

<TLTaxCode>1</TLTaxCode> <!-- Integer - Tax Code. Make sure the format of the cell is “General” else search may not work properly -->

<!-- Values:List as defined in Sage 200. 0=0% Exempt,1=Standard Rate,2=Zero Rated,4=EC Zero SL,5=EC Service SL,6=EC Service PL,7=EC Zero PL,8=EC Std PL etc.-->

</NomLine>

</NomHeader>

</sage200Data>

Example – 230 Nominal Journal Recuring.xml

<?xml version="1.0" ?>

<sage200Data>

<settings>

<companyCode>DEMO03</companyCode>

<mappings>

</mappings>

</settings>

<NomHeader>

<!-- ===== Header ==== -->

<THJournalType>REC</THJournalType> <!-- Text 3 - Journal Type NOM, BAT, REC or REV only -->

<!-- Values:NOM,Normal Journal,REV,Reversing Journal,REC,Recurring Journal-->

<THDate>2017-02-20</THDate> <!-- Date - Overide Heading Date, thus causing a new transaction on change -->

<THRecDates1>2017-03-20</THRecDates1> <!-- Date - Recuring date, if transaction type 2,Accrual Journal -->

<THRecDates2>2017-04-20</THRecDates2>

<THRecDates3>2017-05-20</THRecDates3>

<THRecDates4>2017-06-20</THRecDates4>

<THRef>A Recuring Journal</THRef> <!-- Text 30 - Overide Heading Ref, thus causing a new transaction on change -->

<!-- Sage API 200 post three line Recuring Nominal Journal user either

<TLAmount> or <TLDebit> and <TLCredit>

to define the amounts which must balance -->

<NomLine>

<TLDetails>Optional:Set the description on this line</TLDetails> <!-- Text 60 - Details -->

<TLExterRef>Optional:And an External ref</TLExterRef> <!-- Text 30 - External Referance -->

<TLNomCode>31100/LON/VAL</TLNomCode>

<TLAmount>-100</TLAmount>

</NomLine>

<NomLine>

<TLNomCode>31100/LON/ADM</TLNomCode>

<TLAmount>50</TLAmount>

</NomLine>

<NomLine>

<TLNomCode>31100/SCO/ADM</TLNomCode>

<TLAmount>50</TLAmount>

</NomLine>

</NomHeader>

</sage200Data>

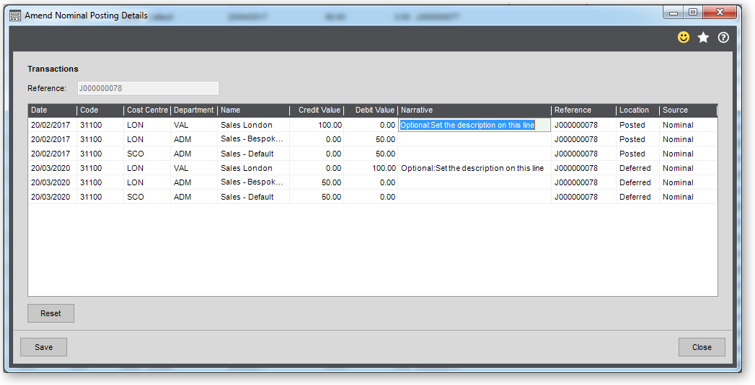

Example – 240 Nominal Journal Reversing.xml

<?xml version="1.0" ?>

<sage200Data>

<settings>

<companyCode>DEMO03</companyCode>

<mappings>

</mappings>

</settings>

<NomHeader>

<!-- ===== Header ==== -->

<THJournalType>REV</THJournalType> <!-- Text 3 - Journal Type NOM, BAT, REC or REV only -->

<!-- Values:NOM,Normal Journal,REV,Reversing Journal,REC,Recurring Journal-->

<THDate>2017-02-20</THDate> <!-- Date - Overide Heading Date, thus causing a new transaction on change -->

<THReversalDate>2020-03-20</THReversalDate> <!-- Date - Reversal date, if transaction type 2,Accrual Journal -->

<THRef>A Reversing Journal</THRef> <!-- Text 30 - Overide Heading Ref, thus causing a new transaction on change -->

<!-- Sage API 200 post three line Reversing Nominal Journal user either

<TLAmount> or <TLDebit> and <TLCredit>

to define the amounts which must balance -->

<NomLine>

<TLDetails>Optional:Set the description on this line</TLDetails> <!-- Text 60 - Details -->

<TLExterRef>Optional:And an External ref</TLExterRef> <!-- Text 30 - External Referance -->

<TLNomCode>31100/LON/VAL</TLNomCode>

<TLAmount>-100</TLAmount>

</NomLine>

<NomLine>

<TLNomCode>31100/LON/ADM</TLNomCode>

<TLAmount>50</TLAmount>

</NomLine>

<NomLine>

<TLNomCode>31100/SCO/ADM</TLNomCode>

<TLAmount>50</TLAmount>

</NomLine>

</NomHeader>

</sage200Data>